Welcome to SmartRetirePlans.com. My name is MHMAHIN, and if you’re like most people, you’ve heard that a Roth IRA is a magical tool for retirement, promising tax-free income when you need it most. But you’re also probably a little skeptical. After all, when does the IRS ever let you get away with not paying taxes?

The question “Do I have to pay tax on my Roth IRA?” is one of the most common and important questions I get. It gets right to the heart of what makes this retirement vehicle so powerful—and so confusing.

The short answer is a resounding no, you generally do not have to pay tax on your Roth IRA.

However, that simple answer comes with a big, bold, red asterisk. The tax-free promise is only true if you follow the rules. When you don’t follow the rules, the Roth IRA can quickly lose its tax advantages and, in some cases, even hit you with penalties. The real art of mastering your Roth IRA is understanding the difference between a “qualified” and a “non-qualified” withdrawal.

In this comprehensive guide, I’m going to demystify the Roth IRA for you. We’ll break down exactly what makes a withdrawal tax-free, when you might owe taxes, and what to do if you need to tap into your Roth IRA money early. My goal is to give you the confidence to manage your Roth IRA effectively so you can enjoy every single penny of your hard-earned retirement savings, completely tax-free.

The Fundamental Principle: The Roth Tax Advantage

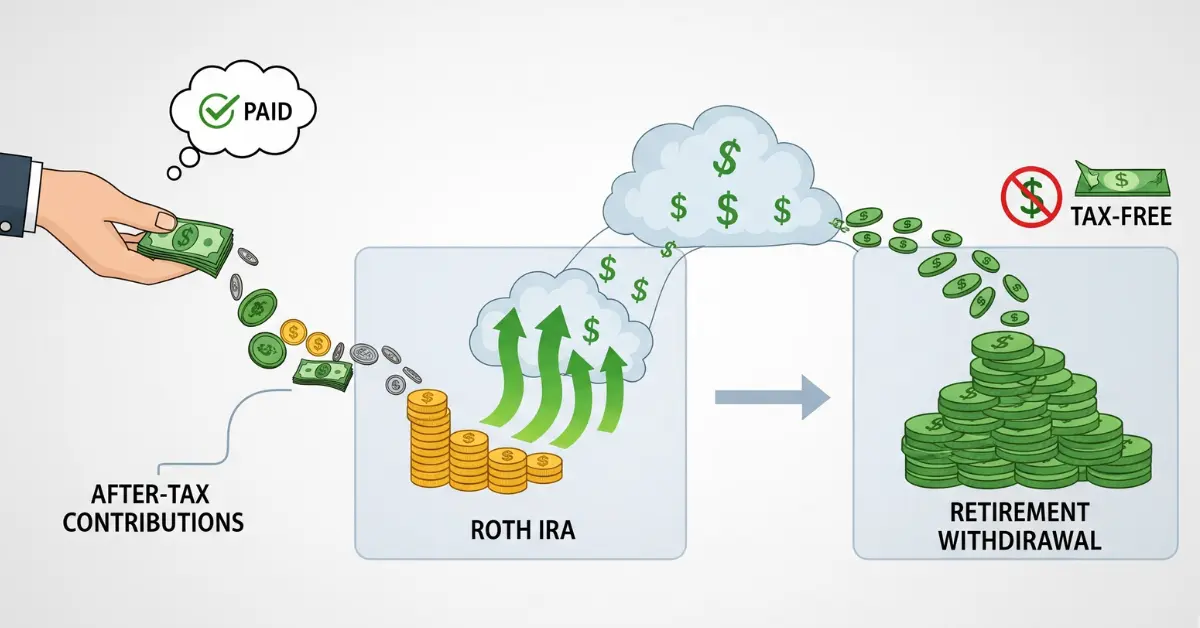

To understand the tax rules of a Roth IRA, you first need to understand the core principle behind it. It’s a “pay now, save later” strategy.

- You Contribute with After-Tax Dollars: When you put money into a Roth IRA, you’re using money you’ve already paid income taxes on. Your contributions are not tax-deductible. This is the opposite of a traditional IRA, where you get a tax deduction for your contributions upfront.

- Your Investments Grow Tax-Free: This is where the magic happens. All of the dividends, capital gains, and interest that your investments generate inside the Roth IRA grow completely free of federal income tax. You will never have to report these gains to the IRS as long as they stay in the account.

- Qualified Withdrawals are 100% Tax-Free: Once you reach retirement and your withdrawals are considered “qualified” by the IRS, every dollar you take out—both your original contributions and all of the growth—is completely free from federal income tax.

The most important takeaway here is that you’re pre-paying the taxes. Because the IRS already got its cut when you earned the money, it doesn’t get to take another cut when you withdraw it. This is why the Roth IRA is a powerful hedge against future tax rate increases.

The Two Conditions for a Tax-Free “Qualified” Withdrawal

To unlock that incredible tax-free retirement income, your withdrawals must be considered “qualified.” A qualified distribution is a withdrawal that meets two specific criteria:

- You Must Be at Least Age 59½: This is the standard retirement age for many types of retirement accounts. Taking money out after you hit this age is the first hurdle to a tax-free withdrawal.

- The 5-Year Rule Must Be Satisfied: This is the most misunderstood and often overlooked rule of the Roth IRA. The IRS requires you to have had the account open for at least five full years before you can make a tax-free withdrawal of your earnings.

Let’s dive a little deeper into that 5-year rule because it’s so important.

Understanding the 5-Year Rule

The 5-year rule is a crucial waiting period for your Roth IRA earnings. Here’s how it works:

- The clock starts ticking on January 1st of the year for which you make your very first Roth IRA contribution.

- The clock applies to all of your Roth IRAs. If you have multiple Roth IRAs, the 5-year period for all of them starts with your first contribution to any Roth IRA you’ve ever owned.

- The clock is separate for each Roth IRA conversion. If you convert a traditional IRA to a Roth IRA, that converted amount has its own separate 5-year clock for avoiding an early withdrawal penalty on the converted amount itself.

Example: Let’s say you open and contribute to your first Roth IRA in December 2025. The 5-year clock officially starts on January 1, 2025. You will satisfy the 5-year rule on January 1, 2030, and any tax-free withdrawals after that date will depend only on your age.

It’s a common mistake to think the 5-year rule starts with your first contribution to a specific Roth IRA. Just remember: one clock for all your Roth IRAs.

What if I Don’t Meet the Qualified Withdrawal Rules? The “Non-Qualified” Scenario

So, what happens if you need to take money out of your Roth IRA before you’re 59½ and/or before the 5-year rule is met?

This is where the tax rules get a bit more complicated, but the good news is that the IRS has a specific ordering for how your withdrawals are treated. They follow a clear hierarchy, which is very favorable to you:

- Contributions First: This is the most user-friendly rule of the Roth IRA. Any money you withdraw is first considered to be your original contributions. Since you already paid taxes on this money, you can take out all of your contributions at any time, for any reason, completely tax- and penalty-free.

- Conversions Next: If you withdraw more than you’ve contributed, the next dollars you pull out are considered to be from any Roth conversions you’ve made. These are generally tax-free but may be subject to a 10% penalty if you withdraw them before their own 5-year clock has run its course.

- Earnings Last: Only after you’ve exhausted all of your contributions and conversions will you start withdrawing from the earnings portion of your account. This is the only part of your Roth IRA that may be subject to taxes and penalties.

If you are under 59½ and withdrawing earnings, you’ll generally be hit with two things:

- Income Tax: You will have to pay ordinary income tax on the amount of earnings you withdraw.

- A 10% Early Withdrawal Penalty: The IRS will also tack on a 10% penalty to the earnings you withdraw.

This is why it’s so important to think of your Roth IRA as a true retirement account and not a bank account. Tapping into the earnings early can significantly reduce its value and cost you thousands of dollars in taxes and fees.

The Silver Lining: Exceptions to the Early Withdrawal Penalty

While the general rule is to avoid withdrawing earnings before age 59½, the IRS understands that life happens. There are several exceptions to the 10% early withdrawal penalty, which allow you to access your Roth IRA earnings without that extra fee. However, a crucial distinction to remember is that the earnings portion of these withdrawals may still be subject to income tax unless you’ve also satisfied the 5-year rule.

Here are some of the most common exceptions to the 10% penalty:

- First-Time Home Purchase: This is a very popular exception. You can withdraw up to $10,000 (lifetime limit) of Roth IRA earnings without the 10% penalty to pay for qualified acquisition costs of a first home. If you’ve also met the 5-year rule, this withdrawal is completely tax- and penalty-free. The definition of a “first-time homebuyer” is simply someone who has not owned a main home in the two years prior to the purchase.

- Qualified Higher Education Expenses: You can withdraw earnings penalty-free to pay for qualified higher education expenses for yourself, your spouse, your children, or your grandchildren.

- Unreimbursed Medical Expenses: If you have medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI) in a given year, you can withdraw earnings penalty-free up to the amount of those expenses.

- Health Insurance Premiums While Unemployed: If you have been unemployed for at least 12 consecutive weeks, you can withdraw earnings penalty-free to pay for health insurance premiums.

- Permanent Disability: If the IRS determines you are totally and permanently disabled, you can withdraw both contributions and earnings penalty-free.

- Substantially Equal Periodic Payments (SEPP): This is a complex strategy that allows you to take a series of equal payments from your Roth IRA over your life expectancy without the 10% penalty.

- Birth or Adoption: You can withdraw up to $5,000 from your Roth IRA penalty-free to cover qualified expenses related to a birth or adoption. This is a recent addition under the SECURE Act 2.0.

As you can see, the Roth IRA is not completely inflexible. It offers a safety net for major life events, but it’s always best to consider these exceptions a last resort to preserve the long-term tax-free growth potential of your account.

What About Required Minimum Distributions (RMDs)?

This is another great feature of the Roth IRA that makes it stand out. Unlike a traditional IRA, which requires you to start taking distributions from your account at age 73 (or later, depending on your birth year), a Roth IRA has no Required Minimum Distributions during your lifetime.

This means you can let your money continue to grow completely tax-free for as long as you live, without being forced to take it out. This is a huge benefit for estate planning and for those who simply don’t need the money in retirement and want to pass on a tax-free inheritance to their beneficiaries.

A Quick Summary for Your SmartRetirePlans.com Blueprint

| Scenario | Tax on Contributions? | Tax on Earnings? | 10% Penalty? |

| Qualified Withdrawal | No | No | No |

| Withdrawal of Contributions Only | No | No | No |

| Non-Qualified Withdrawal of Earnings | No | Yes (Income Tax) | Yes |

| Withdrawal of Earnings (with a Penalty Exception) | No | Yes (Income Tax) | No |

| Withdrawal of Earnings (with a Penalty Exception & 5-year rule met) | No | No | No |

Conclusion: Do I Have to Pay Tax on My Roth IRA?

So, do you have to pay tax on your Roth IRA? The answer is “no,” as long as you play by the rules. The entire value proposition of this account is that you pay your taxes upfront, and in exchange, you get to enjoy a lifetime of tax-free growth and tax-free income in retirement.

My final piece of advice is to treat your Roth IRA with the respect it deserves. It is a long-term retirement savings account, not an emergency fund (even though the contribution portion offers some flexibility). By letting your money grow untouched until you are both over 59½ and have met the 5-year rule, you’ll unlock the full potential of your Roth IRA and secure a more stable, tax-free financial future for yourself.

Start today, understand the rules, and enjoy the peace of mind that comes with knowing a large part of your retirement income will be a gift that the IRS cannot touch.