Welcome to smartretireplans.com!

When you’re building your retirement nest egg, every decision you make has a ripple effect on your financial future. One of the most important choices you’ll face is where to save your money, and when it comes to retirement accounts, the Roth IRA is a superstar. While it may not offer an upfront tax deduction like its traditional counterpart, the Roth IRA provides a unique and powerful set of tax advantages that can fundamentally change your financial picture in retirement.

This article will dive deep into the world of the Roth IRA, explaining exactly how it can help you with taxes—not just today, but for decades to come. We’ll explore the core concepts, the key rules, and the advanced strategies that make this account a cornerstone of smart retirement planning.

The single most powerful benefit of a Roth IRA is its tax treatment in retirement. Unlike a traditional IRA, which offers a tax deduction on contributions but taxes your withdrawals in retirement, the Roth IRA flips the script.

Here’s the simple breakdown:

- You contribute after-tax dollars: When you put money into a Roth IRA, you’ve already paid income tax on that money. You don’t get a tax break for your contributions in the year you make them.

- Your money grows tax-free: The magic happens behind the scenes. All the capital gains, dividends, and interest your investments earn over the years are completely tax-free. Your investments compound without the government taking a cut along the way.

- Your withdrawals are completely tax- and penalty-free in retirement: This is the grand finale. Once you reach age 59½ and have held the account for at least five years (more on this “five-year rule” later), all your withdrawals—contributions and earnings—are completely free of federal income tax.

Think about that for a moment. If you contribute $7,000 a year for 30 years, and that money grows to several hundred thousand dollars, you could potentially withdraw the entire amount tax-free. With a traditional IRA, that entire sum would be subject to your income tax rate in retirement, which could be a significant amount.

The Five-Year Rule: An Important Detail

To ensure your withdrawals are tax- and penalty-free, the Roth IRA has a “five-year rule.” This rule states that you must wait at least five full tax years from the year of your first contribution to the account. For example, if you make your first contribution in June 2025, the five-year clock starts on January 1, 2025. This means you will have satisfied the rule on January 1, 2030.

This rule applies to the withdrawal of earnings, but not to your original contributions. You can withdraw your contributions at any time, for any reason, without penalty or taxes, regardless of your age or how long the account has been open. This provides an incredible amount of flexibility and serves as an emergency fund with a huge upside.

What are “Qualified” and “Non-Qualified” Distributions?

- Qualified Distributions: These are the withdrawals you want to make. They are completely tax- and penalty-free. To be qualified, a withdrawal must meet two conditions:

- The five-year rule must be satisfied.

- You must be 59½ or older, or the withdrawal is for a qualified exception (such as a first-time home purchase, disability, or death).

- Non-Qualified Distributions: These are withdrawals of earnings that don’t meet the qualified distribution requirements. You would have to pay income tax on the earnings portion of the withdrawal, and you might also be subject to a 10% early withdrawal penalty if you’re under 59½ and an exception doesn’t apply.

The beautiful thing about a Roth IRA is the ordering rule: any withdrawals are considered to come from your contributions first, then from conversions, and finally from earnings. This gives you a substantial tax-free buffer before you ever touch the money that would be subject to taxes.

How a Roth IRA Can Be a Powerful Tax Management Tool in Retirement

The tax benefits of a Roth IRA go far beyond simple tax-free withdrawals. A Roth IRA is a key component of a smart, tax-diversified retirement strategy.

1. Hedge Against Future Tax Rate Increases

No one can predict the future, but many financial experts believe that tax rates are likely to increase over time. The United States has a massive national debt, and one of the ways the government can address this is by raising taxes. By contributing to a Roth IRA, you are essentially “prepaying” your taxes at today’s rates. If tax rates go up in the future, all your Roth IRA withdrawals will still be tax-free, protecting you from a potentially higher tax burden.

2. Manage Your Retirement Income Tax Bracket

In retirement, you’ll likely be drawing income from various sources: Social Security, a 401(k) or traditional IRA, and personal savings. Withdrawals from a traditional IRA and a 401(k) are considered taxable income. A Roth IRA gives you the ultimate control.

Imagine you need to withdraw $50,000 in a given year. If all of that money comes from your traditional IRA, it will all be added to your taxable income, potentially pushing you into a higher tax bracket and causing a larger portion of your Social Security benefits to be taxed.

With a Roth IRA, you can be strategic. You could withdraw enough from your traditional IRA to fill a lower tax bracket and then pull the rest of the money you need from your Roth IRA. Those Roth withdrawals don’t count as taxable income, so they won’t push you into a higher tax bracket, nor will they increase the tax on your Social Security benefits.

3. Avoid Required Minimum Distributions (RMDs)

Traditional IRAs and 401(k)s have a drawback: the government eventually forces you to take withdrawals. These are called Required Minimum Distributions (RMDs), and they typically begin at age 73 (or 75, depending on your birth year). RMDs are taxable income and can increase your tax burden in retirement, whether you need the money or not.

Roth IRAs have no RMDs for the original account holder. This is a massive advantage. You can leave the money in your account for as long as you want, letting it grow and compound tax-free. This provides incredible flexibility and is a key reason why a Roth IRA is an excellent tool for legacy planning.

The Ultimate Tax Advantage: Legacy and Estate Planning

For many people, the most significant tax benefit of a Roth IRA comes after they are gone. Roth IRAs are an incredible tool for leaving a tax-free inheritance.

When you pass away, your beneficiaries can inherit your Roth IRA. They will be subject to a “10-year rule,” which generally requires them to withdraw the entire account balance within 10 years of your death. However, as long as the five-year rule has been met, all of those withdrawals will be completely tax-free for your heirs.

Compare this to inheriting a traditional IRA. The beneficiary would have to withdraw the entire account balance within 10 years, and every dollar they withdraw would be taxed at their ordinary income tax rate. This could be a significant tax burden for them, especially if they are in their prime earning years. By leaving a Roth IRA, you’re not just leaving a financial gift; you’re leaving a tax-free financial legacy.

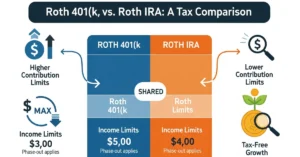

Are There Any Downsides? The Income Limits and Contribution Rules

While a Roth IRA offers fantastic tax advantages, it’s not a perfect fit for everyone. The IRS places limits on who can contribute directly to a Roth IRA based on their income. For 2025, the income phase-out ranges are:

- Single filers: Your ability to contribute begins to phase out if your Modified Adjusted Gross Income (MAGI) is between $150,000 and $165,000. Above $165,000, you can’t make a direct contribution.

- Married couples filing jointly: The phase-out range is between $236,000 and $246,000. Above $246,000, you are ineligible for a direct contribution.

The Backdoor Roth IRA

If your income is above these limits, there is a strategy that high-income earners can use to get money into a Roth IRA, known as the “backdoor Roth IRA.” This involves contributing to a traditional IRA (which has no income limits) and then immediately converting that traditional IRA to a Roth IRA. This process can be complex, and you should always consult with a tax professional or financial advisor before attempting it, especially if you have other pre-tax IRA accounts.

Is a Roth IRA Right for You? A Quick Checklist

The decision to contribute to a Roth IRA often comes down to a simple question: “Do you expect to be in a higher tax bracket now, or in retirement?”

- Choose a Roth IRA if:

- You are young and in a lower tax bracket today. Your contributions will have decades to grow tax-free.

- You believe your income will be higher in retirement.

- You want the flexibility to withdraw your contributions at any time without penalty or tax.

- You want to avoid RMDs in retirement.

- You want to leave a tax-free inheritance.

- Choose a Traditional IRA if:

- You are in a high tax bracket today and need the upfront tax deduction.

- You believe your income will be lower in retirement.

Final Thoughts: How Can a Roth IRA Help with Taxes?

The Roth IRA is more than just another retirement account; it’s a powerful tool for tax planning, wealth management, and legacy creation. By paying your taxes now on a relatively small amount of money, you can potentially save a fortune in taxes on a much larger sum in the future.

The key to maximizing the Roth IRA’s benefits is to start early, contribute consistently, and let the magic of compound interest and tax-free growth work for you over the long term. At smartretireplans.com, we believe that smart planning today leads to a secure and worry-free tomorrow. The Roth IRA is one of the smartest tools you can use to build that future.

FAQ

What is the main tax advantage of a Roth IRA?

The primary tax advantage of a Roth IRA is that your withdrawals in retirement are completely tax- and penalty-free. While you don’t get an upfront tax deduction on your contributions, all the earnings and growth on your investments compound tax-free and can be withdrawn without paying any federal income tax, as long as you meet certain conditions.

Who is eligible to contribute to a Roth IRA?

Eligibility to contribute directly to a Roth IRA is based on your income. The IRS sets income phase-out ranges that determine if you can contribute the full amount, a reduced amount, or nothing at all. For 2025, for example, the phase-out range for single filers is between $150,000 and $165,000 in Modified Adjusted Gross Income (MAGI).

What is the “five-year rule” for a Roth IRA?

The “five-year rule” is a requirement that you must satisfy to make qualified (tax- and penalty-free) withdrawals of your Roth IRA earnings. The rule states that five full tax years must have passed since the first day of the year you made your first contribution to any Roth IRA. This rule does not apply to the withdrawal of your original contributions, which can be taken out at any time without tax or penalty.

How can a Roth IRA help me manage my tax bracket in retirement?

Withdrawals from a Roth IRA are not considered taxable income. This gives you a powerful tool to manage your tax bracket in retirement. You can strategically withdraw money from your taxable accounts (like a Traditional IRA or 401(k)) to keep your taxable income low, and then use tax-free withdrawals from your Roth IRA to cover the rest of your spending needs. This can help you avoid a higher tax bracket and prevent a larger portion of your Social Security benefits from being taxed.

Do Roth IRAs have Required Minimum Distributions (RMDs)?

No. For the original account owner, a Roth IRA has no Required Minimum Distributions (RMDs). This means you can let your money continue to grow tax-free for as long as you live, without being forced to take withdrawals. This is a significant advantage for those who want to use the account as a tool for legacy and estate planning.