SEP IRA Earning Calculator: Your Key to a Secure Retirement

For self-employed professionals and small business owners, the path to a comfortable retirement can seem complex. Unlike employees with access to a traditional 401(k), you are responsible for building your own financial future. This is where a Simplified Employee Pension (SEP) IRA comes in, and more importantly, where a SEP IRA earning calculator becomes an indispensable tool.

A SEP IRA earning calculator is more than just a simple financial tool; it’s a strategic planning partner. It empowers you to go beyond guesswork, providing a clear, data-driven projection of your retirement savings. This article will be your comprehensive guide, explaining what a SEP IRA is, why this calculator is essential, and how you can use it to build a powerful retirement strategy.

Understanding the SEP IRA: A High-Octane Retirement Vehicle

Before we dive into the calculator, let’s understand the foundation. A SEP IRA is a retirement plan designed specifically for self-employed individuals and small businesses. Its primary advantage is the ability to make substantial contributions, far exceeding the limits of a traditional or Roth IRA.

- Who is it for?A SEP IRA is ideal for sole proprietors, freelancers, independent contractors, and small business owners (including partnerships and corporations) who want a straightforward, flexible retirement plan with high contribution limits.

- Key Benefits:

- High Contribution Limits: You can contribute up to the lesser of 25% of an employee’s compensation or $69,000 for 2024 ($70,000 for 2025). For a self-employed individual, the calculation is slightly more complex, but a good calculator handles this for you.

- Employer-Funded: Only the employer (the business owner) makes contributions. This simplifies things as employees cannot contribute their own salary deferrals.

- Flexibility: You are not required to contribute every year. This is particularly beneficial for businesses with fluctuating income.

- Easy to Administer: SEP IRAs are known for their simplicity. There are minimal startup costs and very few administrative requirements.

The Power of the SEP IRA Earning Calculator: Why It’s Non-Negotiable

So, you know a SEP IRA is a great plan, but how do you know if you’re on track? This is where a SEP IRA earning calculator proves its worth. It translates complex financial rules and projections into an easy-to-understand visual representation of your financial future.

Here’s why you absolutely need this tool:

1. Visualize the Magic of Compound Interest

The most powerful force in investing is compound interest. It’s the concept of earning returns on your returns. A calculator can demonstrate this vividly. By inputting your annual contributions and a conservative rate of return, you can see how a small amount today can grow into a massive sum over decades.

For example, imagine a 35-year-old self-employed professional contributes $15,000 annually. A calculator can show that, with a 7% annual return, their SEP IRA could grow to over $1.1 million by age 65. This visualization is a powerful motivator, turning abstract numbers into a tangible retirement goal.

2. Plan for Your Retirement Goals

Do you want to retire at age 60, 65, or even 70? Do you need $1 million, $2 million, or more to live comfortably? A SEP IRA earning calculator allows you to work backward from your goal.

- Scenario A: You want to retire with $1.5 million. The calculator can show you the annual contribution required to reach that goal based on your age and an assumed rate of return.

- Scenario B: You can only afford to contribute $10,000 per year. The calculator will project your retirement fund’s value, allowing you to see if you need to adjust your savings or your retirement timeline.

This “what-if” analysis is crucial for creating a realistic and achievable retirement plan.

3. Simplify Complex Contribution Calculations

For the self-employed, calculating the maximum SEP IRA contribution is not as simple as taking a percentage of your gross income. The IRS has specific rules that require you to calculate contributions based on your net earnings from self-employment, which involves a deduction for one-half of your self-employment tax and the SEP contribution itself.

This “circular calculation” can be a major headache. A dedicated SEP IRA earning calculator automates this complex math, saving you time and ensuring you stay within the IRS limits without over- or under-contributing. It provides a precise number you can use for your tax planning.

4. Compare Different Investment Strategies

The calculator isn’t just about contributions; it’s also about the power of your investments. By adjusting the “annual rate of return” field, you can see the profound impact of different investment choices.

- Conservative Investor: What happens if you only earn a 4% return on your SEP IRA?

- Moderate Investor: What happens with a 7% average return?

- Aggressive Investor: What happens if you aim for a 10% return?

This feature highlights the importance of choosing a suitable investment strategy to meet your long-term goals.

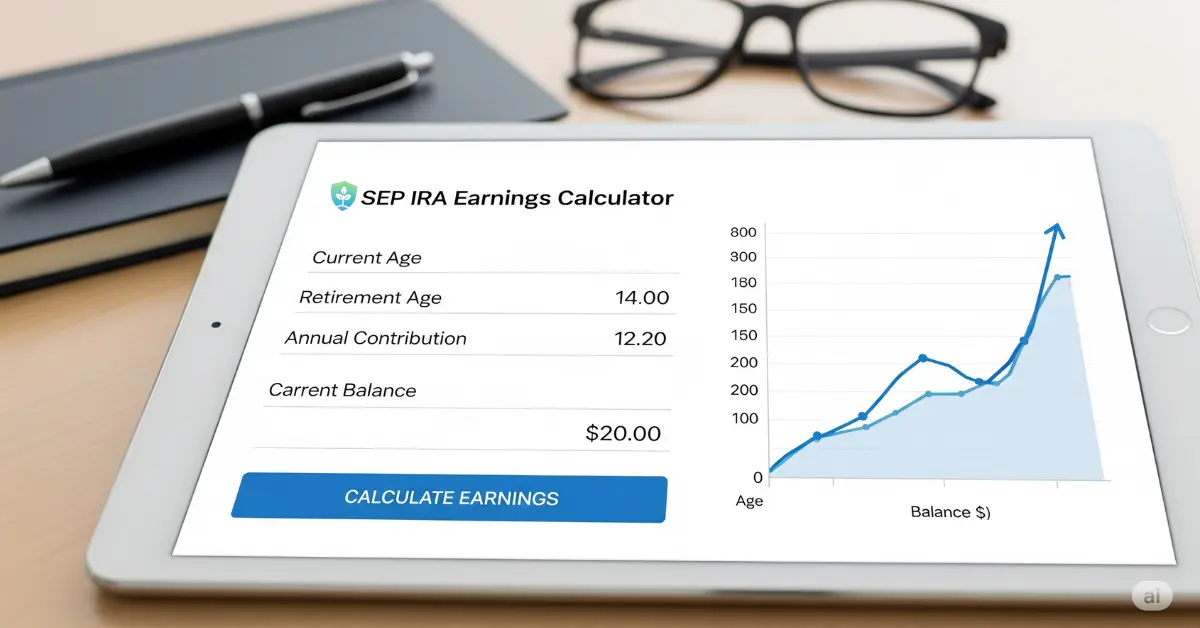

How to Use Our SEP IRA Earning Calculator

Using our SEP IRA earning calculator is incredibly simple. You just need a few pieces of information to get started:

- Current Age: Your age determines the timeframe for your investments to grow. The earlier you start, the more time compounding has to work its magic.

- Annual Net Business Profit: This is your business revenue minus all deductible expenses. This is the starting point for calculating your maximum contribution.

- Annual Contribution Percentage: This is the percentage of your net profit you plan to contribute. Our calculator can help you find your maximum allowable contribution or you can input a different number to see various scenarios.

- Expected Annual Rate of Return: This is an estimate of how much your investments will grow on average each year. While it’s impossible to predict the future, a historical average for a balanced portfolio is a good place to start (e.g., 6-8%).

- Age at Retirement: The age you plan to stop working and start withdrawing from your retirement fund.

Once you input these values, the calculator will instantly generate a detailed projection, showing the projected future value of your SEP IRA, the total amount of your contributions, and the total amount of growth from investment earnings.

SEP IRA vs. Other Retirement Plans: Why This Calculator is Unique

While other retirement calculators exist, a dedicated SEP IRA earning calculator provides a level of specificity that is crucial for self-employed individuals.

- SEP IRA vs. Solo 401(k): A Solo 401(k) allows for both employee and employer contributions, often leading to a higher total limit for some individuals. However, a SEP IRA is much simpler to set up and maintain. Our calculator can help you quickly assess if the SEP IRA’s high contribution limit is sufficient for your goals, making the choice between the two plans much easier.

- SEP IRA vs. Traditional/Roth IRA: The contribution limits for a Traditional or Roth IRA are significantly lower. A standard IRA calculator would not accurately reflect the growth potential of a SEP IRA. Our tool highlights the massive advantage of a SEP IRA’s higher limits and how that translates to a much larger retirement nest egg.

Beyond the Calculator: Maximizing Your SEP IRA

While the calculator provides a powerful roadmap, a few additional tips can help you maximize your retirement savings:

- Start Early: Time is your greatest asset. The sooner you start contributing, the more time your money has to grow.

- Contribute Consistently: Even in years when you can’t contribute the maximum, regular contributions, no matter how small, will add up over time.

- Review Regularly: Revisit the calculator annually or whenever your income changes. This allows you to stay on track and adjust your strategy as needed.

- Choose the Right Investments: Your rate of return is crucial. Consult with a financial advisor to build a diversified portfolio that aligns with your risk tolerance and long-term goals.

- Consider Catch-Up Contributions: If you are age 50 or older, you may be eligible for catch-up contributions to other plans, but the SEP IRA’s high limits often make it a better vehicle for late-career savings without needing special catch-up rules.

Conclusion: Take Control of Your Retirement Future

For the self-employed, a secure retirement doesn’t happen by accident. It requires a clear strategy and the right tools. Our SEP IRA earning calculator is designed to be the foundational tool in your retirement planning arsenal.

It demystifies the complex world of retirement savings, provides a clear view of your financial future, and empowers you to make informed decisions. Start using our calculator today and take the first step toward building the retirement you’ve always envisioned.

What is the purpose of this calculator?

The SEP IRA earning calculator is designed to help self-employed individuals and small business owners plan for retirement by simplifying the complex process of estimating future earnings and contributions for a SEP IRA.

Who should use this calculator?

This tool is specifically useful for self-employed individuals and small business owners who are considering or have a SEP IRA. It helps them understand the potential growth of their retirement savings and plan for their financial future.

What inputs do I need to use the calculator?

To get the most accurate results, you will need to input your annual net business profit, your current age, and your expected rate of return on investments.

How does this calculator differ from other retirement calculators?

This calculator is tailored to the unique rules and higher contribution limits of SEP IRAs. It simplifies the complex “circular calculation” required to determine the maximum contribution for a self-employed individual.

What are the benefits of using this calculator?

The calculator provides several key benefits:

Visualize Compound Interest: It helps you see the powerful effect of compound interest on your retirement savings over time.

“What-If” Analysis: You can adjust variables to perform different scenarios and plan for specific retirement goals.

Simplify Complex Calculations: It handles the complex calculations required for self-employed individuals to determine their maximum contribution.

Compare Investment Strategies: By changing the expected rate of return, you can compare how different investment strategies might impact your future retirement savings.