When it comes to retirement planning, one of the most common questions people ask is: “Which IRA gives highest return?” The truth is, there isn’t a one-size-fits-all answer. The type of Individual Retirement Account (IRA) that provides the best returns depends on your income, tax situation, investment strategy, and long-term goals.

In this guide, we’ll break down different types of IRAs, explore how they perform, compare their potential returns, and help you figure out which IRA might give the highest return for your personal retirement plan.

What is an IRA and Why Does It Matter for Returns?

An Individual Retirement Account (IRA) is a tax-advantaged savings account designed to help individuals prepare for retirement. Unlike regular savings accounts, IRAs let your money grow either tax-deferred (you pay taxes later) or tax-free (you pay taxes upfront, but withdrawals are tax-free).

The return you get from an IRA isn’t fixed — it depends on the investments you choose inside the account. Stocks, bonds, mutual funds, ETFs, CDs, or even real estate (with self-directed IRAs) all come with different growth potentials.

So, the “highest return” IRA isn’t just about the account type — it’s about how you invest within it.

Types of IRAs and Their Potential Returns

Let’s take a closer look at the most common IRA options and what kind of returns they can provide.

1. Traditional IRA

- Tax Advantage: Contributions may be tax-deductible, meaning you reduce your taxable income now.

- Withdrawals: Taxed as ordinary income in retirement.

- Potential Returns: Historically, stock-heavy portfolios in Traditional IRAs average around 7%–10% annually over the long term.

- Best For: People who expect to be in a lower tax bracket during retirement.

2. Roth IRA

- Tax Advantage: Contributions are made with after-tax dollars, but withdrawals in retirement are completely tax-free.

- Withdrawals: Tax-free (if rules are followed).

- Potential Returns: Also 7%–10% annually when invested in stocks or diversified funds. The tax-free withdrawals often make Roth IRAs the best long-term return option for younger investors.

- Best For: People who expect to be in a higher tax bracket later, or want to lock in tax-free growth.

3. SEP IRA

- For: Self-employed individuals and small business owners.

- Tax Advantage: Contributions are tax-deductible, and the limits are much higher than Traditional/Roth IRAs (up to 25% of compensation, max $69,000 in 2024).

- Potential Returns: Same as Traditional IRAs, but the higher contribution limit means more money growing tax-deferred, which can supercharge your wealth.

- Best For: Entrepreneurs and freelancers who want to save aggressively.

4. SIMPLE IRA

- For: Small businesses with 100 or fewer employees.

- Tax Advantage: Tax-deferred contributions, both from employer and employee.

- Potential Returns: Similar to Traditional IRA returns, but with higher contribution limits than regular IRAs.

- Best For: Employees of small businesses who don’t have access to a 401(k).

5. Self-Directed IRA (SDIRA)

- Unique Feature: Lets you invest in non-traditional assets like real estate, private businesses, precious metals, or even cryptocurrency.

- Potential Returns: Can be much higher (or riskier). For example, real estate investments might yield 10%+ annually, while crypto could be much higher but very volatile.

- Best For: Experienced investors who want full control and are comfortable with higher risks.

Which IRA Really Gives the Highest Return?

If we’re talking pure potential, the Self-Directed IRA could give the highest return because it allows investments in high-growth assets like real estate and startups. However, this comes with high risk.

For balanced, long-term retirement growth, the Roth IRA often delivers the best net return because of its tax-free withdrawals. Even if you earn the same 8% return as a Traditional IRA, avoiding taxes later can mean thousands of extra dollars in your pocket.

Factors That Determine IRA Returns

While the type of IRA plays a role, the returns you get depend mostly on your investment choices. Let’s break down the main factors:

1. Investment Choices

- Stocks & Equity Funds: Historically average 7%–10% annual return over decades.

- Bonds: Lower risk, typically 2%–5% annual return.

- Mutual Funds & ETFs: Diversified returns, depending on mix of stocks/bonds.

- Real Estate (via Self-Directed IRA): Can generate 8%–12% annually, but depends heavily on market cycles.

- Crypto/Alternative Assets: Potentially sky-high returns, but highly volatile.

2. Fees & Expenses

High management fees can eat away at your returns. A difference of just 1% in annual fees can cost you hundreds of thousands over 30 years. Always compare IRA providers’ fee structures.

3. Tax Treatment

- Roth IRAs give tax-free withdrawals, which means your after-tax return may actually be higher than a Traditional IRA.

- Traditional IRAs let you lower your taxable income now, but you’ll owe taxes later.

4. Time Horizon

The longer you let your investments grow, the higher the compound returns. A 25-year-old maxing out a Roth IRA could end up with 2x more retirement money than someone starting at age 40.

Historical IRA Return Examples

To give you a real-world perspective, let’s look at some numbers:

- S&P 500 Index (1926–2023): Average annual return ~ 10% before inflation, 7% after inflation.

- Bond Funds: Average ~ 4%–5% annual return.

- Balanced Portfolio (60% stocks / 40% bonds): ~ 6%–8% annual return.

So if you invested $6,500 per year (the 2024 IRA contribution limit) into:

- Roth IRA (S&P 500 fund, 8% annual growth) → ~$1.1 million in 40 years (all tax-free).

- Traditional IRA (same fund, 8% annual growth, taxed at 20% on withdrawal) → ~$880,000 net after taxes.

- SEP IRA (contributing $20,000 per year, 8% annual growth) → ~$3.3 million in 40 years.

👉 This shows how both contribution limits and tax rules affect your “real” returns.

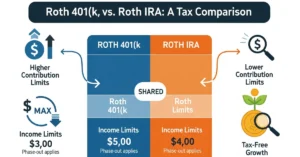

Roth vs. Traditional IRA: Which Gives Higher Net Return?

Let’s compare them directly:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contributions | Pre-tax | After-tax |

| Withdrawals | Taxed | Tax-free |

| Best If… | You expect lower income tax in retirement | You expect higher income tax in retirement |

| Real Return | Slightly lower due to taxes on withdrawals | Higher net return due to tax-free growth |

Verdict: For younger investors, the Roth IRA often wins because tax-free withdrawals can significantly boost your net return. For high earners close to retirement, a Traditional IRA might make more sense.

SEP & SIMPLE IRAs: Higher Contributions = Higher Returns

Even though SEP and SIMPLE IRAs don’t have special tax-free withdrawals like Roth IRAs, their higher contribution limits mean you can grow a much larger retirement fund.

For example:

- SEP IRA allows contributions up to $69,000 (2024). If you max this out annually, your retirement balance could be several million dollars larger than a Roth IRA.

- The return percentage may be the same, but the absolute dollar growth is much bigger.

Self-Directed IRA: The Wild Card

If you’re an experienced investor, a Self-Directed IRA can unlock unique opportunities:

- Real Estate Rentals: Consistent 8–12% annual return from cash flow + property appreciation.

- Private Startups: Can yield 100x returns, but very risky.

- Precious Metals: Hedge against inflation, average return much lower than stocks.

- Crypto: Extremely high return potential, but volatility can wipe out your portfolio.

👉 Self-Directed IRAs can provide the highest potential returns but are not for beginners.

Pros and Cons of Each IRA Type

| IRA Type | Pros | Cons |

|---|---|---|

| Traditional IRA | Tax-deductible now, good for lowering taxable income | Taxes due on withdrawals, RMDs required |

| Roth IRA | Tax-free withdrawals, no RMDs, great for young investors | No upfront tax deduction |

| SEP IRA | High contribution limits, great for business owners | Employer-funded only, stricter rules |

| SIMPLE IRA | Higher limits than Traditional/Roth, employer match | Less flexible than 401(k), lower limits than SEP |

| Self-Directed IRA | Maximum investment freedom, highest potential | Risky, requires expertise, strict IRS rules |

Final Thoughts: Which IRA Gives Highest Return?

So, which IRA gives the highest return?

- If you want highest potential and are comfortable with risk → Self-Directed IRA.

- If you want highest realistic net return with long-term stability → Roth IRA.

- If you want to maximize contribution size → SEP IRA (for self-employed).

The key isn’t just the IRA type but how you invest within it. A Roth IRA filled with low-risk bonds won’t beat a SEP IRA invested in stocks. On the other hand, tax-free compounding in a Roth can give you the edge over a Traditional IRA with the same investments.

👉 The bottom line: The best IRA for you depends on your tax situation, income level, and retirement goals.

FAQs: Which IRA Gives the Highest Return?

Which IRA type has the highest return?

A Self-Directed IRA has the highest potential, but a Roth IRA gives the best long-term tax-free net returns for most investors.

Can I lose money in an IRA?

Yes. Returns depend on investments. Stocks can go down in the short term, but long-term returns are historically positive.

How much can I expect my IRA to grow?

If you invest $6,500 annually at 8% return, you could have around $1.1 million in 40 years.

Should I pick Roth or Traditional?

If you’re young or expect higher taxes later → Roth.

If you’re close to retirement and need deductions now → Traditional.

Can I have multiple IRAs?

Yes, but the total contribution limit ($6,500 for 2024, or $7,500 if age 50+) applies across all accounts.