As a parent, you’re always looking for the best ways to secure your child’s future. One of the biggest hurdles many families face is the ever-increasing cost of higher education. If you’ve been diligently contributing to a Roth IRA, you might be wondering, “Can I use my Roth IRA for my child’s education?”

The short answer is yes, you can. But like most things involving personal finance, the long answer is a bit more nuanced. While using your Roth IRA for college expenses can be a powerful tool, it’s crucial to understand the rules, potential tax implications, and alternative options available. This guide will walk you through everything you need to know, helping you make an informed decision that’s right for your family.

The Power of the Roth IRA: A Quick Refresher

Before we dive into using your Roth IRA for education, let’s quickly recap what makes this retirement account so special. A Roth IRA is a retirement savings vehicle where you contribute after-tax dollars. The magic of the Roth IRA lies in its tax-free growth and tax-free withdrawals in retirement, provided you meet certain conditions.

To qualify for tax-free withdrawals, you must have held the account for at least five years (known as the “five-year rule”) and be 59½ or older. But here’s the crucial part for our discussion: the IRS has carved out specific exceptions that allow you to withdraw your contributions (and sometimes earnings) without the usual 10% early withdrawal penalty, even if you’re not yet 59½. One of those exceptions is for qualified education expenses.

The Rules of the Game: Using Your Roth IRA for Education

When it comes to using your Roth IRA for your child’s college costs, there are two distinct types of withdrawals you need to understand:

- Withdrawing Your Contributions: This is the most straightforward and flexible part. Because you contributed after-tax money to your Roth IRA, you can withdraw your contributions at any time, for any reason, and completely tax- and penalty-free. There’s no age requirement and no five-year rule to worry about. This is a huge advantage, as it gives you a pool of accessible funds for an emergency or, in this case, for education. Think of your contributions as a “tax-free savings account” that also happens to be growing for your retirement.

- Withdrawing Your Earnings: This is where the rules become more important. If you need to dip into the earnings (the growth your investments have made over time), you can do so for qualified education expenses without incurring the 10% early withdrawal penalty. However, you will still have to pay income tax on the amount of earnings you withdraw.

So, the key takeaway is: Your contributions come out first, tax- and penalty-free. Once you’ve exhausted your contributions, any subsequent withdrawals will be considered earnings. These earnings can be withdrawn penalty-free for education, but you will owe income tax on them.

What are “Qualified Education Expenses”?

The IRS is very specific about what counts as a qualified education expense. To avoid the 10% penalty on earnings, the money must be used for expenses related to enrollment or attendance at an eligible educational institution. This includes:

- Tuition and fees: The big one!

- Books, supplies, and equipment: Required for the student’s courses.

- Room and board: For students enrolled at least half-time. This includes both on-campus housing and off-campus rent and utilities.

- Computers and related equipment: Software, internet access, or other tech expenses if they are required for enrollment or attendance.

An “eligible educational institution” is a college, university, vocational school, or other postsecondary educational institution that is eligible to participate in the Department of Education’s student aid programs. This generally includes most accredited schools in the U.S.

The FAFSA Factor: A Hidden Pitfall

While a Roth IRA can be a great resource, it’s crucial to understand how it can impact financial aid. This is a potential pitfall that many parents overlook.

When you fill out the Free Application for Federal Student Aid (FAFSA), you are required to report your assets. However, assets held in a retirement account, like a Roth IRA, are not counted as an asset on the FAFSA. This is a significant advantage, as it means your Roth IRA won’t directly impact your child’s eligibility for need-based financial aid.

The complication arises when you start making withdrawals. Withdrawals from your Roth IRA are considered income in the year they are taken. The FAFSA uses a “prior-prior year” tax return to determine a student’s aid eligibility. This means that if you withdraw funds from your Roth IRA in 2024 to pay for your child’s freshman year in the fall of 2025, that withdrawal will show up as income on your 2024 tax return. When you fill out the FAFSA in the fall of 2026 for the 2027-2028 academic year, that income could negatively impact your child’s financial aid eligibility for their junior year.

This is a critical point to consider. A large withdrawal could reduce your child’s eligibility for grants and scholarships, potentially offsetting the benefit of using your Roth IRA.

The smart strategy here: If you plan to use your Roth IRA for education, consider waiting until your child is in their final years of college. By then, the FAFSA is less likely to be a major factor, as they will have already received aid for their first few years. Alternatively, if you need to withdraw funds early on, try to make the withdrawal in a year when it will have the least impact on the FAFSA cycle.

A Comparison: Roth IRA vs. 529 Plan

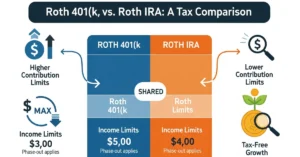

The Roth IRA isn’t the only game in town for education savings. The 529 plan is specifically designed for this purpose. Let’s compare the two to help you decide which is the better option for your family.

| Feature | Roth IRA | 529 Plan |

| Purpose | Retirement savings, with education as a secondary benefit. | Education savings. |

| Tax Treatment | Contributions are after-tax. Withdrawals of contributions are tax-free. Withdrawals of earnings are tax-free in retirement, or penalty-free but taxable for education. | Contributions are after-tax. Withdrawals are completely tax-free if used for qualified education expenses. |

| Contribution Limits | Annual limits apply ($6,500 for 2023, with a catch-up for those 50+). | No annual limits, but lifetime limits vary by state. Can contribute significant sums. |

| Investment Options | Broad range of investment options, chosen by you (stocks, bonds, ETFs, etc.). | Limited to the specific investment options offered by the plan, typically a selection of mutual funds. |

| Flexibility | High. Can withdraw contributions at any time for any reason. | Less flexible. If money is withdrawn for non-education expenses, earnings are subject to income tax and a 10% penalty. |

| Financial Aid (FAFSA) | Not counted as an asset. Withdrawals are counted as income. | Counted as a parent asset (if owned by the parent), which has a minimal impact on financial aid. Withdrawals are not counted as income. |

| Beneficiary | Only you, the account holder. Can be used for your child’s education, but it’s still your account. | You are the owner, but a specific beneficiary (e.g., your child) is named. Can be changed. |

The Verdict:

- Choose a 529 plan if your primary goal is to save exclusively for your child’s education. The tax-free growth and withdrawals for qualified expenses are a huge advantage, and the FAFSA treatment is more favorable.

- Choose a Roth IRA if you want to prioritize retirement while keeping a flexible, accessible safety net for education. It’s a great option if you’re not sure if your child will go to college or if you want the flexibility to use the money for other purposes down the road.

Many financial advisors suggest a “both/and” approach. Maximize your Roth IRA contributions first to secure your own retirement, and then contribute to a 529 plan. This gives you the best of both worlds: a strong retirement foundation and a dedicated, tax-advantaged account for college.

Practical Steps and Smart Strategies

If you’ve decided that using your Roth IRA for your child’s education is the right path for you, here are some practical steps to take:

- Assess Your Retirement Needs First: Before you touch a single dollar in your Roth IRA, be honest with yourself. Is your retirement on track? Raiding your retirement savings now could have a significant impact on your future self. Use a retirement calculator to see if your plan is still solid even after a withdrawal.

- Calculate Your Contributions vs. Earnings: Get a clear picture of how much of your Roth IRA is made up of contributions and how much is earnings. Your account statements or online portal should have this information. It’s always best to withdraw from the contributions first to avoid any tax liability.

- Time Your Withdrawals Strategically: As mentioned earlier, be mindful of the FAFSA cycle. If you can, delay withdrawals until your child’s junior or senior year of college to minimize the impact on financial aid eligibility.

- Keep Meticulous Records: When you make a withdrawal, be sure to document that the funds were used for qualified education expenses. Keep copies of tuition bills, receipts for books, and other relevant documentation. You’ll need this to prove to the IRS that the withdrawal of earnings was penalty-free.

- Consider a Loan as a Last Resort: If you’re faced with a large tuition bill and your retirement is not fully funded, it might be better to take out a student loan than to deplete your Roth IRA. Student loans can be paid back over a long period, and they won’t permanently damage your retirement nest egg.

The Bottom Line: Can I use my Roth IRA for my child’s education?

Using your Roth IRA for your child’s education is a viable and flexible option, but it’s not a decision to be made lightly. The tax-free access to your contributions is a powerful benefit, but dipping into your earnings and potentially impacting financial aid are significant drawbacks.

Your Roth IRA is first and foremost a retirement account. While it’s a wonderful feeling to be able to help your child with their college expenses, it’s equally important to ensure you don’t compromise your own financial security in the process. By understanding the rules, considering the alternatives, and planning strategically, you can make the best choice for both your family’s present and future.

FAQ

Can I use my Roth IRA to pay for my child’s college education?

Yes, you can. The IRS allows you to withdraw funds from your Roth IRA to pay for qualified education expenses for yourself, your spouse, your children, or your grandchildren without incurring the usual 10% early withdrawal penalty.

What’s the difference between withdrawing contributions and withdrawing earnings for education?

This is a crucial distinction.

Contributions: The money you have personally put into the Roth IRA can be withdrawn at any time, for any reason, completely tax- and penalty-free.

Earnings: Any growth on your investments (the earnings) can be withdrawn penalty-free for qualified education expenses, but you will still have to pay ordinary income tax on that portion of the withdrawal.

What expenses qualify for a penalty-free withdrawal?

The IRS defines “qualified education expenses” as:

Tuition and fees

Books, supplies, and required equipment

Room and board (for students enrolled at least half-time)

These expenses must be for an eligible educational institution, which includes most accredited colleges, universities, and vocational schools.

How does a Roth IRA withdrawal affect my child’s financial aid eligibility?

This is a major consideration. While the money held within a Roth IRA is not counted as an asset on the FAFSA (Free Application for Federal Student Aid), any withdrawals you make are considered income in the year they are taken. Since the FAFSA uses “prior-prior year” income data, a withdrawal could significantly reduce your child’s eligibility for need-based grants and scholarships in a subsequent academic year.

Can I use my Roth IRA to pay for my child’s K-12 tuition?

No. While 529 plans can be used to pay for K-12 tuition (up to a certain limit), the penalty-free education expense exception for a Roth IRA only applies to qualified expenses for post-secondary education.

What if my child doesn’t go to college?

This is one of the key advantages of a Roth IRA. If your child chooses not to pursue higher education, the money you’ve saved remains in your retirement account, continuing to grow tax-free for your own future. With a 529 plan, non-qualified withdrawals of earnings are subject to both income tax and a 10% penalty.