When it comes to saving for retirement, the words “Roth” and “tax-free” often grab attention. Two of the most popular options are the Roth 401(k) and the Roth IRA. Both accounts let your money grow tax-free, and withdrawals in retirement are generally tax-free, too. But when it comes to taxes, are they truly the same?

The short answer is no—while they share similarities, there are important differences in how they work for taxes, contributions, withdrawals, and income limits. In this guide, we’ll break down the differences, explain how each account is taxed, and help you decide which one might be best for your retirement strategy.

Welcome to SmartRetirePlans.com. My name is MHMAHIN, and I’m here to help you navigate the often-confusing world of retirement savings.

If you’re diving into the world of retirement planning, you’ve probably heard of both the Roth 401(k) and the Roth IRA. On the surface, they seem almost identical. Both are powerful retirement vehicles that promise one of the greatest gifts in personal finance: tax-free growth and tax-free withdrawals in retirement.

But when it comes to the details—especially the nitty-gritty tax rules—the two accounts are far from the same. Thinking of them as interchangeable is a mistake that could cost you thousands of dollars in missed opportunities or unexpected tax bills down the road.

The question “Is Roth 401k The Same as Roth IRA For Taxes?” is a critical one, and the short answer is no. While their core tax benefit is the same, they have significant differences in contribution limits, eligibility, employer matching, and withdrawal rules.

In this comprehensive guide, I’ll walk you through everything you need to know. We’ll break down the subtle but crucial distinctions, helping you understand not just how they work, but which one (or both!) is the right fit for your unique financial situation. By the time you’re done reading, you’ll be armed with the knowledge to make smarter, more strategic decisions for your retirement.

The Core Tax Similarity: The “Roth” Advantage

Before we get into the differences, let’s start with what makes both accounts a “Roth.” This is the foundational concept that ties them together.

The defining feature of any Roth account is its tax treatment:

- Contributions are made with after-tax dollars. This means the money you put into a Roth 401(k) or Roth IRA has already been taxed as part of your income for the year. You don’t get an upfront tax deduction on your contributions.

- Your investments grow tax-free. The magic of compound interest works wonders inside these accounts, and the best part is that you won’t owe a single penny of capital gains or dividend taxes on the earnings as they accumulate.

- Qualified withdrawals are 100% tax-free. When you take money out in retirement, as long as you follow the rules, every dollar—both your original contributions and all the growth—comes out completely free of federal income tax.

This last point is the “holy grail” for many savers. It’s a powerful hedge against future tax increases. If you believe you’ll be in a higher tax bracket in retirement than you are today, or you simply want the peace of mind of a tax-free income stream in the future, a Roth account is an indispensable tool.

This is where the similarity ends. Now, let’s explore the key differences that make these two accounts distinct.

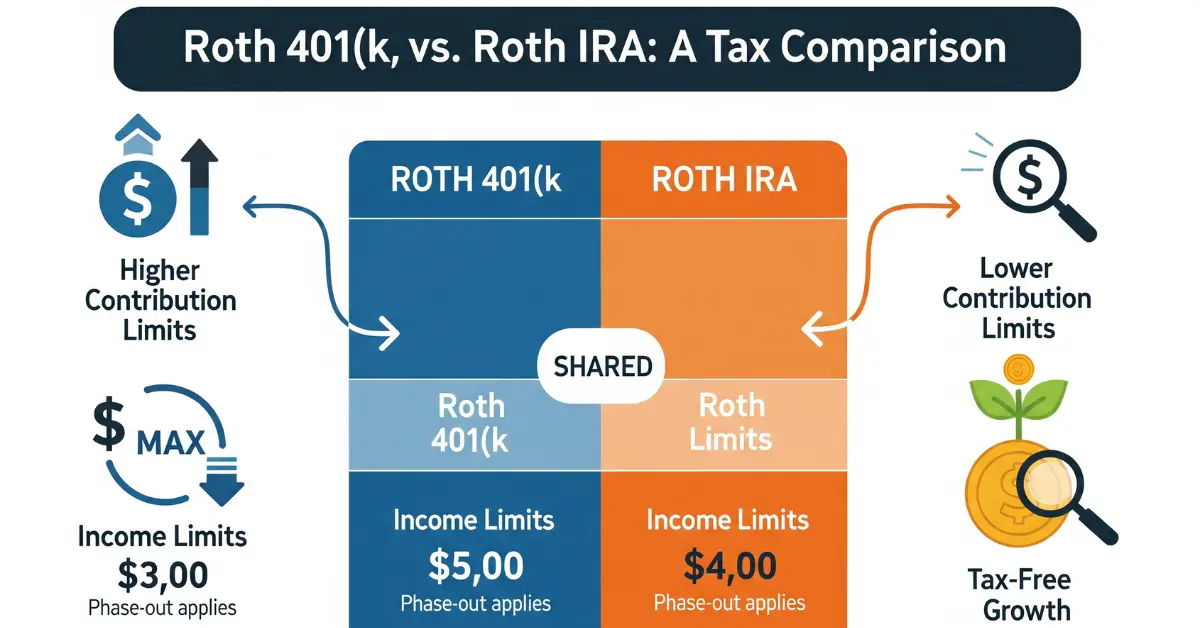

Difference 1: Contribution Limits

The first and most apparent difference is how much money you can put into each account. This is a major factor in how quickly you can build your nest egg.

- Roth IRA Contribution Limit: For 2025, the contribution limit for a Roth IRA is $7,000. If you are age 50 or older, you can make an additional “catch-up” contribution of $1,000, for a total of $8,000. The key thing to remember is that this limit is an aggregate for all of your IRAs (both Roth and traditional). You can’t contribute $7,000 to a Roth IRA and another $7,000 to a traditional IRA in the same year.

- Roth 401(k) Contribution Limit: The Roth 401(k) is designed for much larger contributions. In 2025, the contribution limit is a staggering $23,500. For those age 50 and older, the catch-up contribution is a generous $7,500, bringing the total possible contribution to $31,000. And for those between ages 60 and 63, the limit is even higher at $34,750 due to a new “super catch-up” provision.

As you can see, the Roth 401(k) offers significantly more saving power. If your goal is to supercharge your retirement savings, the Roth 401(k) is the clear winner here.

Difference 2: Income and Eligibility Rules

This is perhaps the most critical distinction for many high-income earners.

- Roth IRA Income Limits: A Roth IRA is an individual account, and to contribute to it, your income must be below a certain level. For 2025, the ability to contribute is phased out for single filers with a Modified Adjusted Gross Income (MAGI) between $150,000 and $165,000. For married couples filing jointly, the phase-out range is between $236,000 and $246,000. If your income is above these upper thresholds, you are not eligible to make a direct contribution to a Roth IRA.

- Roth 401(k) Income Limits: Here’s the game-changer. The Roth 401(k) has no income limits. This makes it an incredibly powerful tool for high-income professionals who are locked out of contributing to a Roth IRA. As long as your employer offers a Roth 401(k) option, you can contribute up to the maximum annual limit, regardless of how much you earn.

For many, the Roth 401(k) is the only way to get money into a Roth-style account. It’s a fantastic option for those who are on a high-earning career path and want to take advantage of tax-free growth but are over the Roth IRA income limit.

(A quick note on the “Backdoor Roth IRA”: While high-income earners can get money into a Roth IRA via a complex process of converting a traditional IRA, the Roth 401(k) offers a much simpler, more direct route for those with high income.)

Difference 3: Employer Matching Contributions

This is a key area where the tax rules diverge significantly and often cause confusion.

- Roth IRA: A Roth IRA is an individual account you open on your own with a brokerage firm (like Fidelity, Vanguard, or Charles Schwab). Because it’s not tied to an employer, there is no possibility of employer matching. You are responsible for all contributions.

- Roth 401(k): Since a 401(k) is an employer-sponsored plan, it is eligible for employer matching. This is often described as “free money” and can be a huge boost to your savings. However, here’s the crucial tax detail: Employer matching contributions are always made on a pre-tax basis. Even if you contribute to a Roth 401(k), the employer’s matching funds go into a separate, traditional 401(k) bucket within the same plan. This means those matching funds, and all their earnings, will be taxed as ordinary income when you withdraw them in retirement.

So, while your own Roth 401(k) contributions will grow and be withdrawn tax-free, the matching funds from your employer will be tax-deferred, just like a traditional 401(k). This is a critical point to understand when estimating your tax situation in retirement.

Difference 4: Withdrawal Rules and Access to Your Money

This is where the accounts have very different levels of flexibility, especially before retirement.

To make a withdrawal of earnings tax-free and penalty-free from either a Roth 401(k) or a Roth IRA, you must meet two criteria:

- You must be age 59½ or older.

- Your account must have met the 5-year rule, meaning it’s been at least five years since January 1st of the year you made your first contribution to the account.

However, the rules for early withdrawals (before age 59½) are where the accounts differ significantly.

- Roth IRA Early Withdrawals: This is one of the Roth IRA’s greatest strengths. You can withdraw your contributions at any time, for any reason, with absolutely no tax or penalty. This is because you’ve already paid taxes on that money. This makes a Roth IRA an excellent emergency fund alternative for some, as it offers easy access to your principal if a major financial crisis hits, without derailing your retirement goals with penalties. You can’t, however, withdraw the earnings portion without tax and a 10% penalty, unless you meet a specific exception (e.g., first-time home purchase up to $10,000, certain medical expenses).

- Roth 401(k) Early Withdrawals: This is the opposite of the Roth IRA. With a Roth 401(k), all withdrawals—contributions and earnings—are treated differently. If you need to take an early withdrawal, you will likely face a 10% penalty and taxes on the pro-rata portion of the withdrawal that is considered earnings. There are a few limited exceptions, such as the “Rule of 55,” which allows you to take penalty-free withdrawals if you leave your job in or after the year you turn 55. But overall, the Roth 401(k) is far less flexible for accessing your money before retirement age.

The bottom line here is that the Roth IRA offers much greater flexibility and liquidity, while the Roth 401(k) is a more rigid savings vehicle designed to be left untouched until retirement.

Difference 5: Required Minimum Distributions (RMDs)

For many years, this was another key difference, but recent legislation has brought the two accounts in line with one another.

- Roth IRA: Roth IRAs have never been subject to Required Minimum Distributions (RMDs) during the account owner’s lifetime. This means you can let the money continue to grow tax-free for as long as you live, which is a fantastic estate planning tool.

- Roth 401(k): Historically, Roth 401(k)s were subject to RMDs, forcing you to start taking distributions from your account at age 73 (or 75, depending on your birth year). However, thanks to the SECURE Act 2.0, passed in late 2022, RMDs for Roth 401(k)s are eliminated starting in 2024. This change aligns the Roth 401(k) with the Roth IRA, making both excellent tools for long-term tax-free growth and wealth transfer.

A Quick Comparison Table

| Feature | Roth 401(k) | Roth IRA |

| 2025 Contribution Limit | $23,500 ($31,000 for age 50+) | $7,000 ($8,000 for age 50+) |

| Income Limits | No income limits for contributions. | Yes, contributions are phased out for high earners. |

| Employer Matching | Yes, but matches are pre-tax and go to a traditional 401(k). | No employer matching. |

| Early Withdrawal of Contributions | Generally subject to a 10% penalty and taxes on the earnings portion. | Tax- and penalty-free at any time. |

| RMDs | No RMDs during the account owner’s lifetime. | No RMDs during the account owner’s lifetime. |

| Investment Options | Limited to the funds offered by your employer’s plan. | Vast universe of investment options (stocks, bonds, ETFs, etc.). |

| Administration | Managed through your employer’s plan administrator. | Managed by you at a brokerage firm of your choice. |

So, Which One is Best for You?

The answer, as with most things in personal finance, is that it depends on your unique situation. In many cases, the best strategy is to use both.

When a Roth 401(k) is the better choice:

- You’re a high-income earner. If your income is too high to contribute to a Roth IRA, the Roth 401(k) is your best (and often only) direct path to tax-free retirement growth.

- You want to maximize your savings. With its much higher contribution limits, the Roth 401(k) allows you to put away a significant amount of money each year.

- Your employer offers a matching contribution. This is the easiest “free money” you can get. Even though the match is pre-tax, it’s a powerful incentive to take advantage of your employer’s plan.

When a Roth IRA is the better choice:

- You want more control over your investments. The Roth IRA gives you the freedom to choose from virtually any investment, from individual stocks to low-cost index funds from various providers. A 401(k) is often limited to a smaller selection of mutual funds.

- You want a flexible emergency fund. The ability to withdraw your contributions penalty- and tax-free provides a valuable safety net without jeopardizing your long-term savings.

- Your employer doesn’t offer a Roth 401(k). This is a simple but common reason. If the option isn’t available, the Roth IRA is your primary path to tax-free growth.

- You want to diversify your retirement accounts. Having both a Roth 401(k) and a Roth IRA is a great way to spread your investments across different platforms and investment options.

The SmartRetirePlans.com Recommendation: A Layered Approach

For most people, a layered approach is the most effective strategy. Here’s my recommended game plan:

- Contribute to your Roth 401(k) up to the employer match. This is non-negotiable. Don’t leave free money on the table. Even though the match is pre-tax, it’s a guaranteed return on your investment that you can’t get anywhere else.

- Max out your Roth IRA. If your income allows, open a Roth IRA and contribute the maximum amount each year. This gives you a secondary tax-free growth vehicle with greater investment flexibility and withdrawal liquidity.

- Go back and max out your Roth 401(k). If you have more money to save after maxing out your Roth IRA, go back to your Roth 401(k) and contribute the rest of your funds up to the annual limit. This maximizes your tax-free growth potential for the year.

- Use a traditional 401(k) for additional savings. If you’re a high earner and are already maxing out your Roth 401(k) and Roth IRA, you can use the traditional 401(k) portion of your employer plan to save even more. While these contributions are pre-tax, they can still be a valuable tool in your retirement arsenal.

This strategy ensures you take full advantage of employer matching, capitalize on the flexibility of the Roth IRA, and maximize your overall tax-advantaged savings for a comfortable and secure retirement.

Conclusion: Is Roth 401k The Same as Roth IRA For Taxes?

To circle back to our original question: “Is Roth 401k The Same as Roth IRA For Taxes?” The answer is a definitive no. While they share the powerful benefit of tax-free growth and withdrawals, the rules governing their contributions, eligibility, and access to funds are fundamentally different.

Understanding these distinctions is not just an academic exercise; it’s a critical part of building a sound, long-term financial plan. By knowing the rules, you can strategically use each account to your advantage, building a diversified and robust retirement portfolio that is protected from future taxes.

Remember, the goal is not to choose between them, but to understand how to use each one as a strategic component of your overall retirement blueprint.

Now that you have this knowledge, you can approach your retirement planning with clarity and confidence. The future you is thanking you for it.

What is the main difference between a Roth 401(k) and a Roth IRA?

The most significant difference lies in their rules and accessibility. While both offer tax-free withdrawals in retirement, the Roth 401(k) is an employer-sponsored plan with much higher contribution limits and no income eligibility restrictions. The Roth IRA is an individual account with lower contribution limits and strict income limits for who can contribute.

Can I contribute to both a Roth 401(k) and a Roth IRA in the same year?

Yes, you absolutely can! The contribution limits for a Roth 401(k) and a Roth IRA are completely separate. This means you can contribute the maximum to your Roth 401(k) through your employer and also contribute the maximum to your Roth IRA, provided your income is below the IRS limit for the Roth IRA. For many people, this strategy of using both accounts is the most effective way to maximize tax-free retirement savings.

My income is too high to contribute to a Roth IRA. Can I still open a Roth 401(k)?

Yes, this is one of the Roth 401(k)’s greatest advantages. Unlike the Roth IRA, the Roth 401(k) has no income restrictions. As long as your employer offers the option, you can contribute to a Roth 401(k) regardless of how much you earn. This makes it an invaluable tool for high-income earners who want to build a tax-free retirement nest egg.

What happens to my employer’s matching contributions in my Roth 401(k)?

This is a crucial point of confusion for many savers. Any employer matching contributions are always made on a pre-tax basis, even if you are contributing to a Roth 401(k). This means the matching funds and any earnings they generate will be placed in a separate traditional (pre-tax) 401(k) bucket within your plan. When you eventually withdraw that money in retirement, it will be subject to income tax.

Can I withdraw my contributions from a Roth 401(k) at any time without taxes or penalties?

No, this is a key difference. With a Roth IRA, you can withdraw your contributions at any time without taxes or penalties. A Roth 401(k) is a different story; it is a long-term retirement vehicle, and early withdrawals are generally subject to a 10% penalty and taxes on the portion considered earnings. However, a special exception called the “Rule of 55” allows for penalty-free withdrawals if you leave your job in or after the year you turn 55.