Roth IRA Calculator: Estimate Your Tax-Free Retirement Savings Easily

What Is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a powerful retirement savings tool that allows you to invest after-tax money today and withdraw your earnings tax-free in retirement. Unlike a traditional IRA, contributions to a Roth IRA are not tax-deductible, but your withdrawals — including growth — are completely tax-free after age 59½.

This makes the Roth IRA one of the most tax-efficient ways to grow long-term wealth in the United States.

Looking for a reliable way to protect your retirement savings from inflation and market uncertainty? Lear Capital offers trusted Gold and Silver IRA solutions backed by over 25 years of experience. Whether you’re rolling over your 401(k) or starting a new precious metals IRA, Lear Capital makes the process simple and secure.

💰 Get Your Free 2025 Gold IRA Kit Today and discover how physical gold and silver can help safeguard your financial future.

🎁 Limited Time Offer: Open your account now and get a $500 account credit* toward your precious metals purchase!

👉 Click here to claim your free kit and explore Lear Capital’s latest offers

Why Use a Roth IRA Calculator?

A Roth IRA calculator helps you understand how much your investments can grow over time and how your tax-free savings might look by the time you retire.

By entering your current balance, monthly contributions, age, and expected return rate, you can estimate:

- Your total contributions

- Your expected tax-free growth

- Your total balance at retirement

This tool gives you a clear financial picture and helps you plan your retirement strategy more effectively.

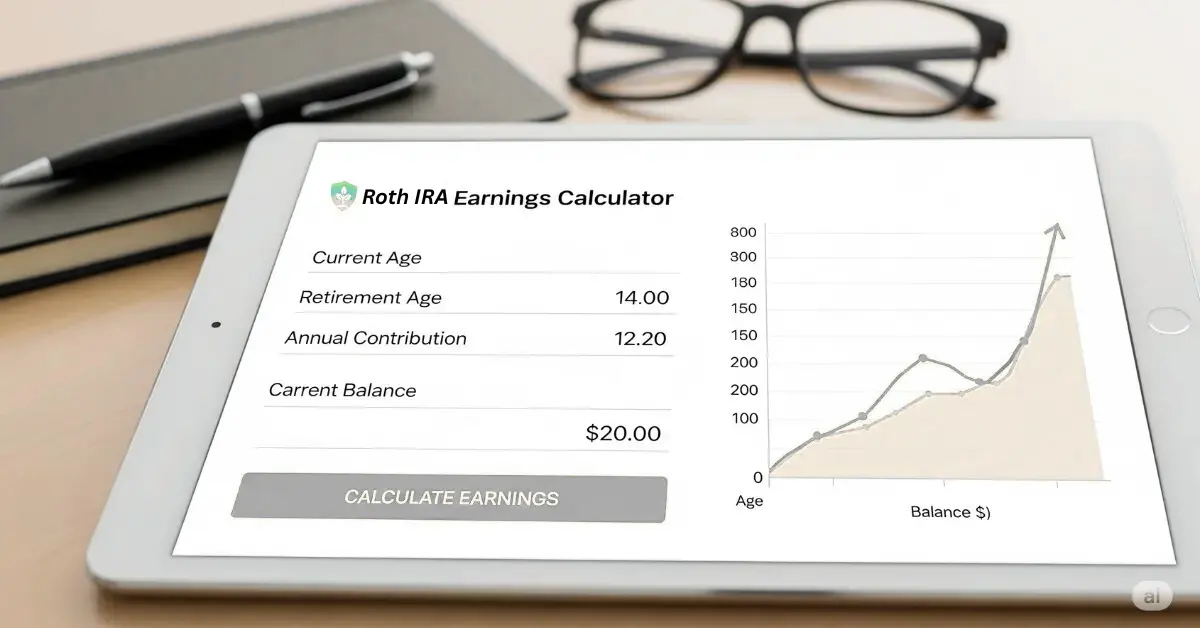

How the Roth IRA Calculator Works

Our Roth IRA Calculator uses compound interest formulas to show how your contributions grow over time.

Here’s what it considers:

- Current Age – Helps determine how many years you have until retirement.

- Retirement Age – The target age when you want to access your funds.

- Current Balance – The amount already saved in your Roth IRA.

- Monthly Contribution – The amount you plan to add each month.

- Annual Rate of Return – The estimated yearly growth of your investments.

You can change these values anytime to see different financial outcomes based on your personal savings strategy.

Example Calculation

Let’s assume:

- Current Age: 30

- Retirement Age: 65

- Current Balance: $10,000

- Monthly Contribution: $500

- Annual Return: 7%

After 35 years, your Roth IRA balance could grow to nearly $1.1 million, and all withdrawals would be completely tax-free under current U.S. tax laws.

Benefits of a Roth IRA

- ✅ Tax-Free Growth – Your earnings grow without being taxed.

- ✅ No Required Minimum Distributions (RMDs) – Unlike traditional IRAs, you can leave your money in as long as you want.

- ✅ Flexible Withdrawals – You can withdraw your contributions anytime (without penalties).

- ✅ Estate Planning Advantage – Heirs can inherit Roth IRAs tax-free.

Contribution Limits (2025)

As of 2025, the Roth IRA contribution limits are:

- $7,000 per year for individuals under 50

- $8,000 per year for those age 50 and older (including the $1,000 catch-up contribution)

Income limits also apply, and eligibility phases out for higher earners. Always check the latest IRS guidelines before contributing.

Try the Roth IRA Calculator Below

Use our interactive Roth IRA Calculator to project your tax-free retirement savings and plan smarter for your financial future.

Final Thoughts

A Roth IRA is one of the smartest ways to secure a tax-free retirement income. Using a Roth IRA calculator helps you see how consistent contributions and time in the market can turn even small monthly deposits into a significant nest egg.

Start planning early, contribute regularly, and let compound growth work its magic!

Frequently Asked Questions (FAQ)

What is a Roth IRA calculator used for?

A Roth IRA calculator helps you estimate how much your Roth IRA could grow over time. It factors in your contributions, current balance, expected rate of return, and years until retirement. This allows you to predict your tax-free retirement savings and make smarter financial decisions.

How accurate is a Roth IRA calculator?

The calculator provides an estimate, not a guarantee. Actual results depend on market performance, contribution changes, and inflation. However, it gives a realistic projection based on standard compound interest formulas and your entered data.

How do Roth IRA withdrawals work?

Roth IRA withdrawals are tax-free if:

You’re at least 59½ years old, and

Your account has been open for 5 or more years.

You can withdraw your contributions anytime (without penalty), but early withdrawal of earnings may trigger taxes or penalties.

What are the 2025 Roth IRA contribution limits?

For 2025, contribution limits are:

$7,000 per year if you’re under age 50.

$8,000 per year if you’re 50 or older (includes $1,000 catch-up).

Your ability to contribute may phase out based on income level — check the IRS income limits for Roth IRAs before contributing.